Do you control your finances, or do your finances control you?

Money decisions affect every part of life, from daily spending to long-term security. Yet most people have never been taught how to manage it.

Why Financial Literacy Matters

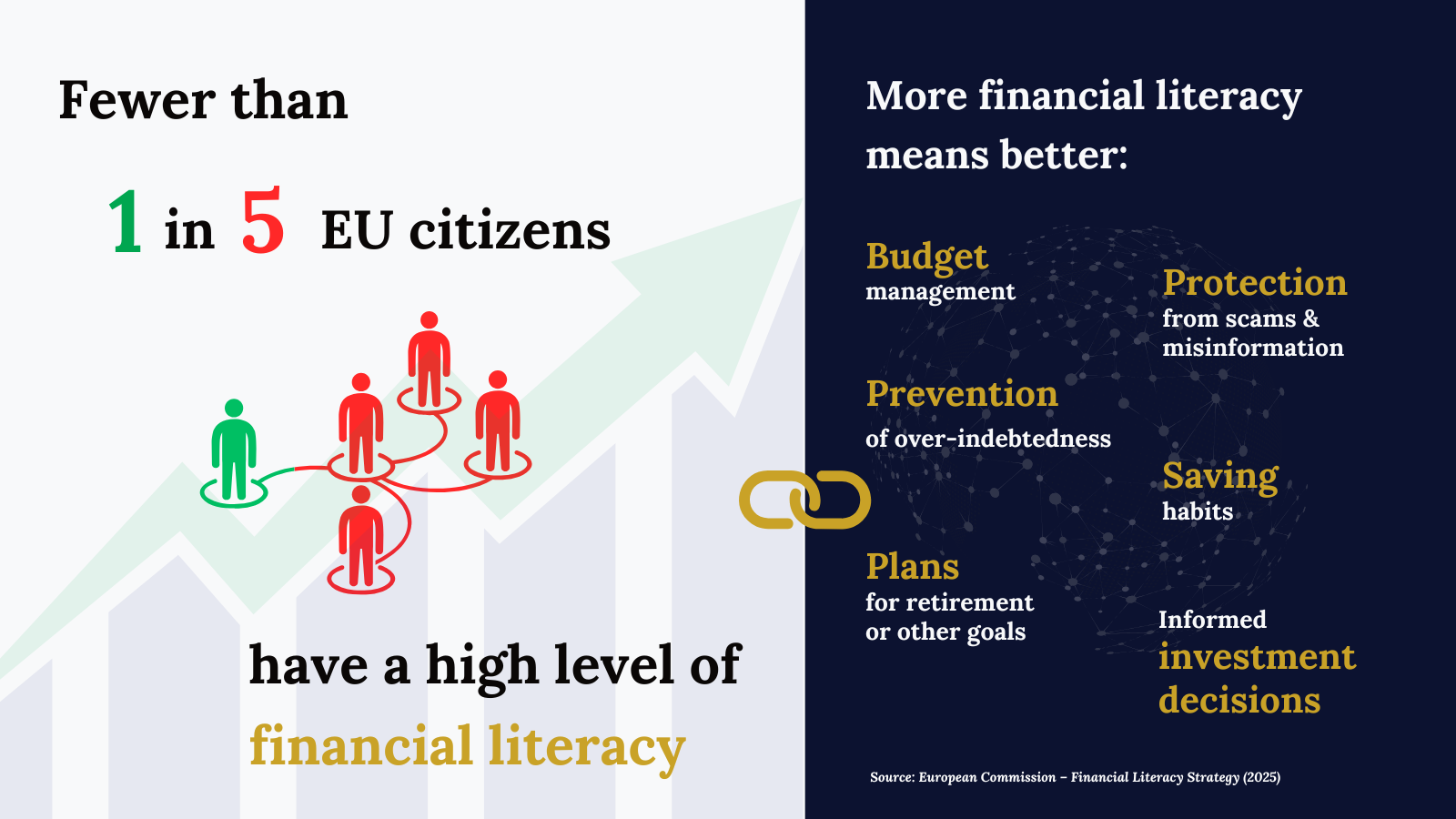

Fewer than one in five adults in the EU have a high level of financial literacy. (European Commission – Financial Literacy Strategy 2025)

Financial literacy turns uncertainty into informed choices. It helps people manage money, avoid costly mistakes, and plan confidently for the future.

Stronger Day-to-Day Decisions

Budget with purpose, avoid debt traps, and build resilient money habits.

Protection & Preparedness

Spot scams and misinformation, build buffers, and face the unexpected with confidence.

Planning for Tomorrow

Save and invest wisely, aligning your money with long-term goals and values.

Our 14-week program translates these priorities into clear, weekly actions — from budgeting and debt to compounding, investing, and a practical wealth-planning framework.

Practical Education

Clear, purpose-driven learning that connects everyday money choices with long-term goals. Start with the 14-week Financial Literacy Program and build confidence step by step.